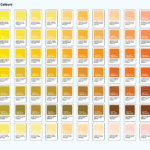

Looking to understand deed taxes in Minnesota? You’re in the right place! Deed taxes can be confusing, but with the help of a printable deed tax chart, you can easily navigate the process.

Whether you’re a homebuyer, seller, or real estate agent, having a clear understanding of deed taxes is essential. Luckily, a printable deed tax chart for Minnesota can simplify the process and help you calculate the amount you owe.

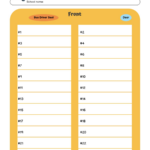

Printable Deed Tax Chart For Minnesota

Printable Deed Tax Chart For Minnesota

When it comes to deed taxes in Minnesota, the amount you owe is based on the sale price of the property. By using a printable deed tax chart, you can quickly determine the tax rate and calculate the total amount due.

Deed taxes are typically paid by the seller at the time of closing. The tax rate varies depending on the sale price of the property, with higher-priced properties subject to a higher tax rate. Consulting a printable deed tax chart can help you estimate the amount you’ll need to pay.

Having a printable deed tax chart on hand can save you time and money when it comes to understanding and calculating deed taxes in Minnesota. Whether you’re buying or selling a property, being informed about deed taxes is key to a smooth transaction.

Don’t let deed taxes catch you off guard! With a printable deed tax chart for Minnesota, you can easily navigate the process and ensure you’re prepared for any tax obligations that may arise.

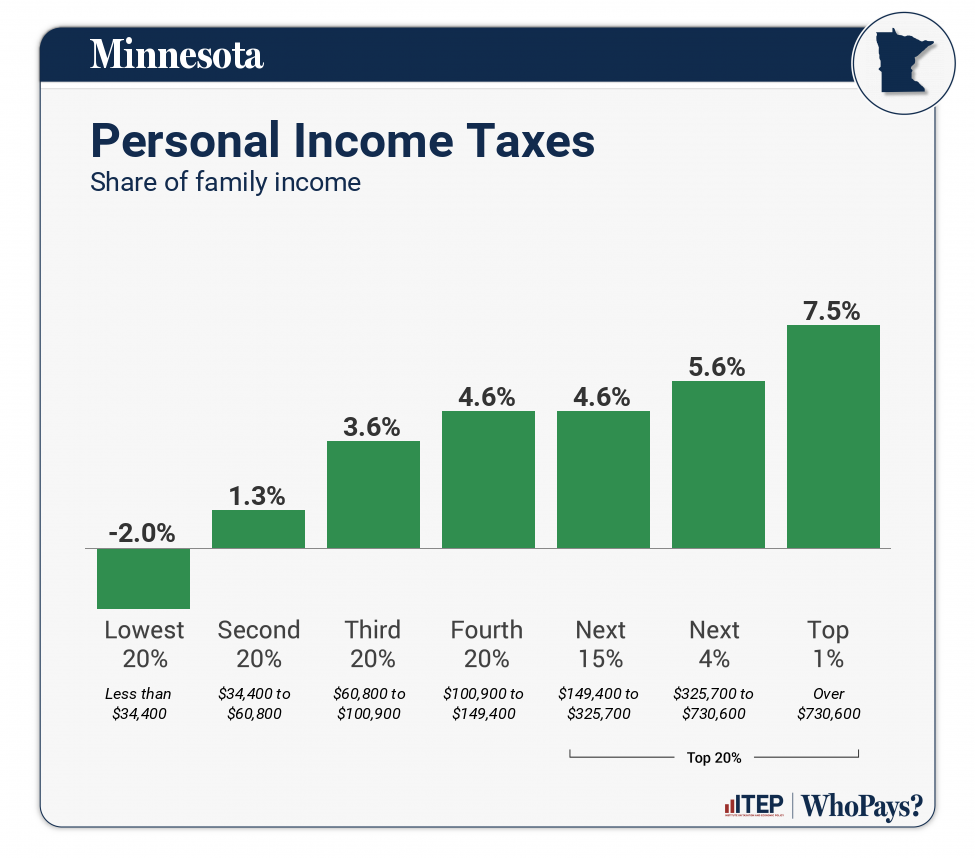

Minnesota Who Pays 7th Edition ITEP

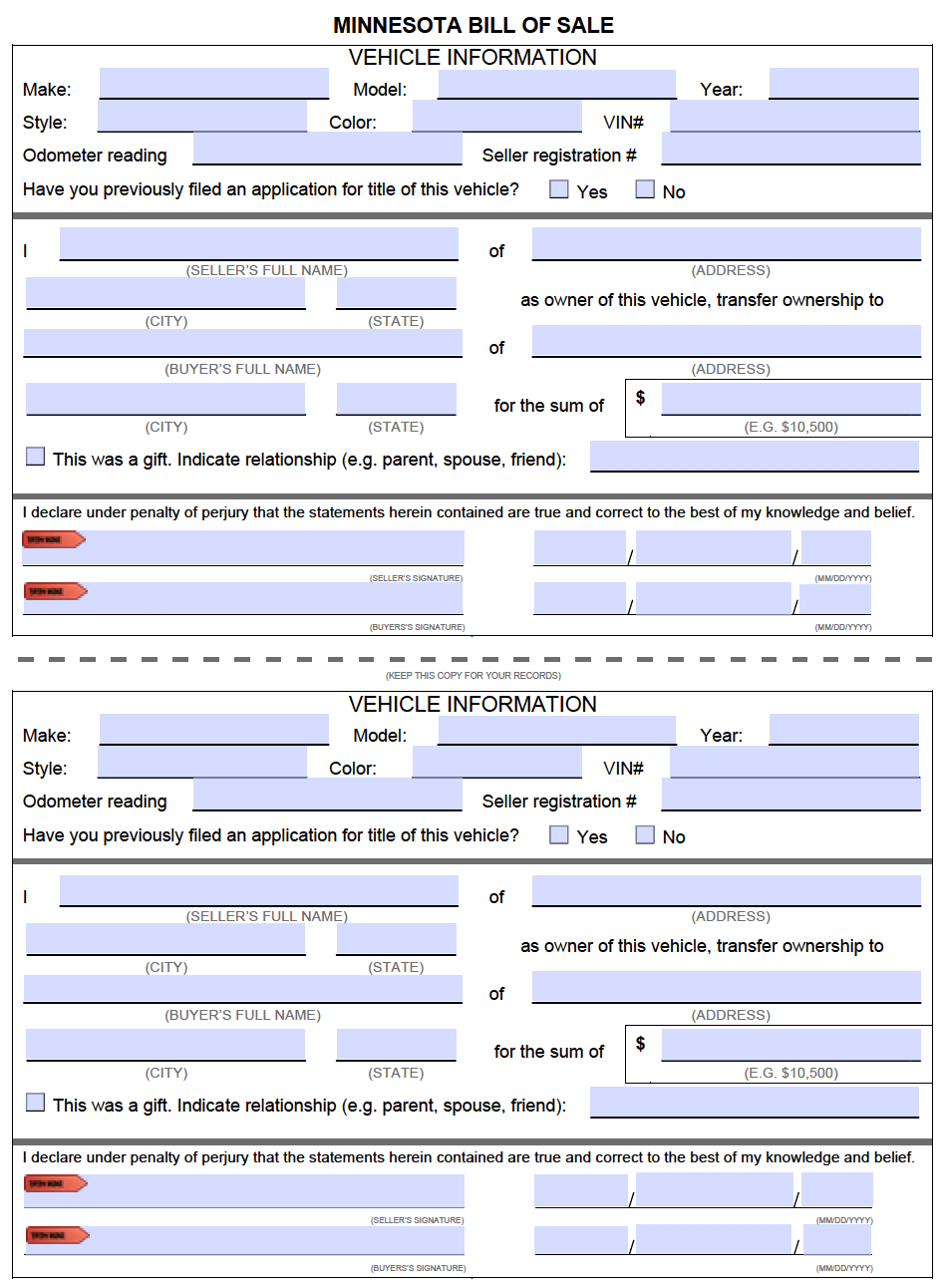

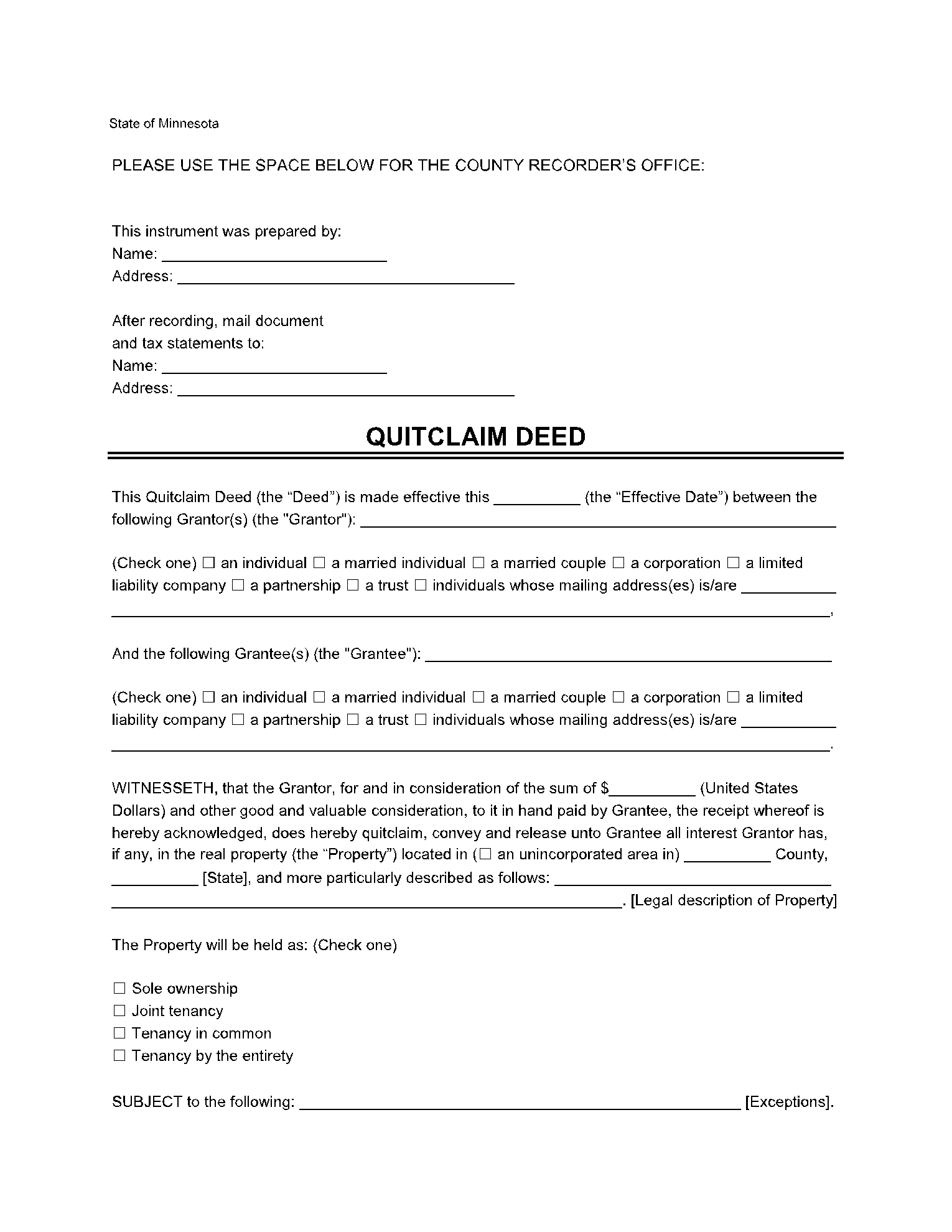

Free Minnesota Quit Claim Deed Form 2021 CocoSign

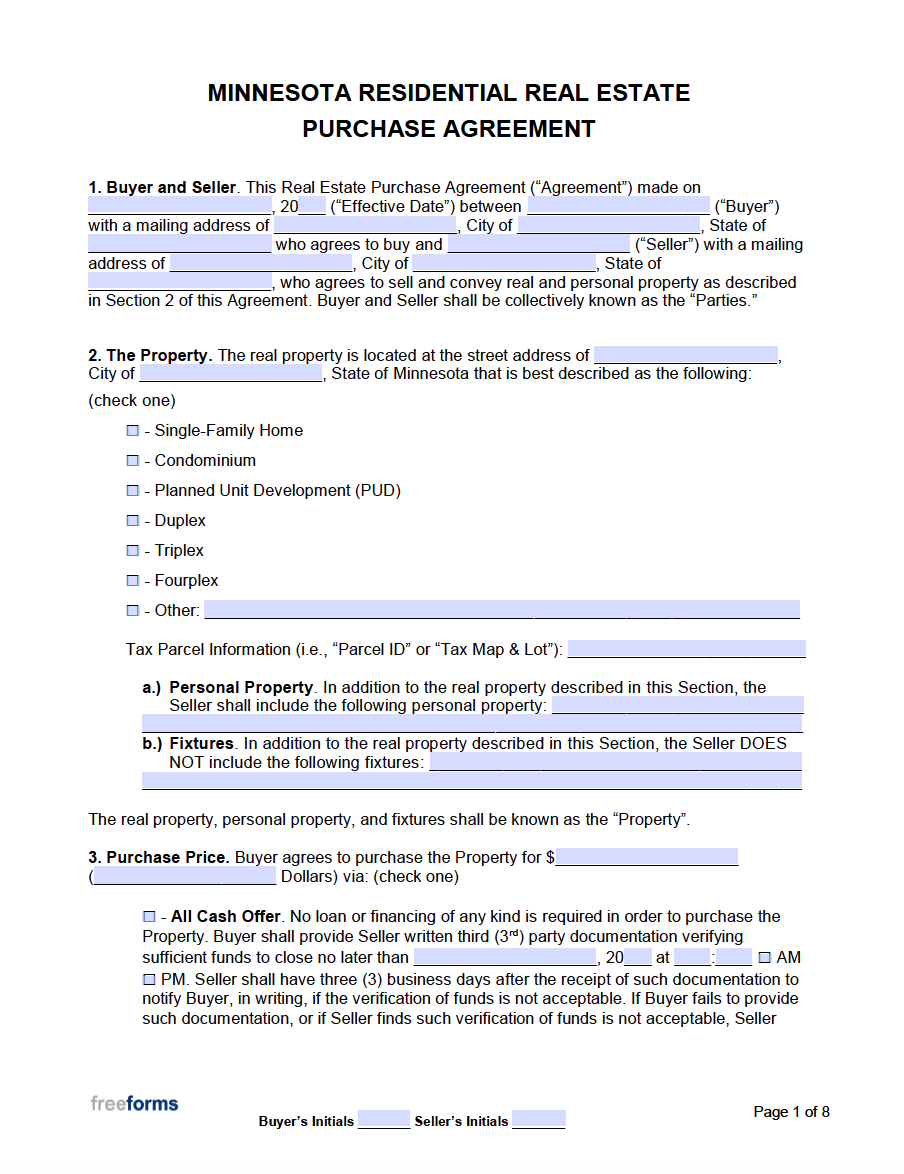

Free Minnesota Real Estate Purchase Agreement Template PDF Word

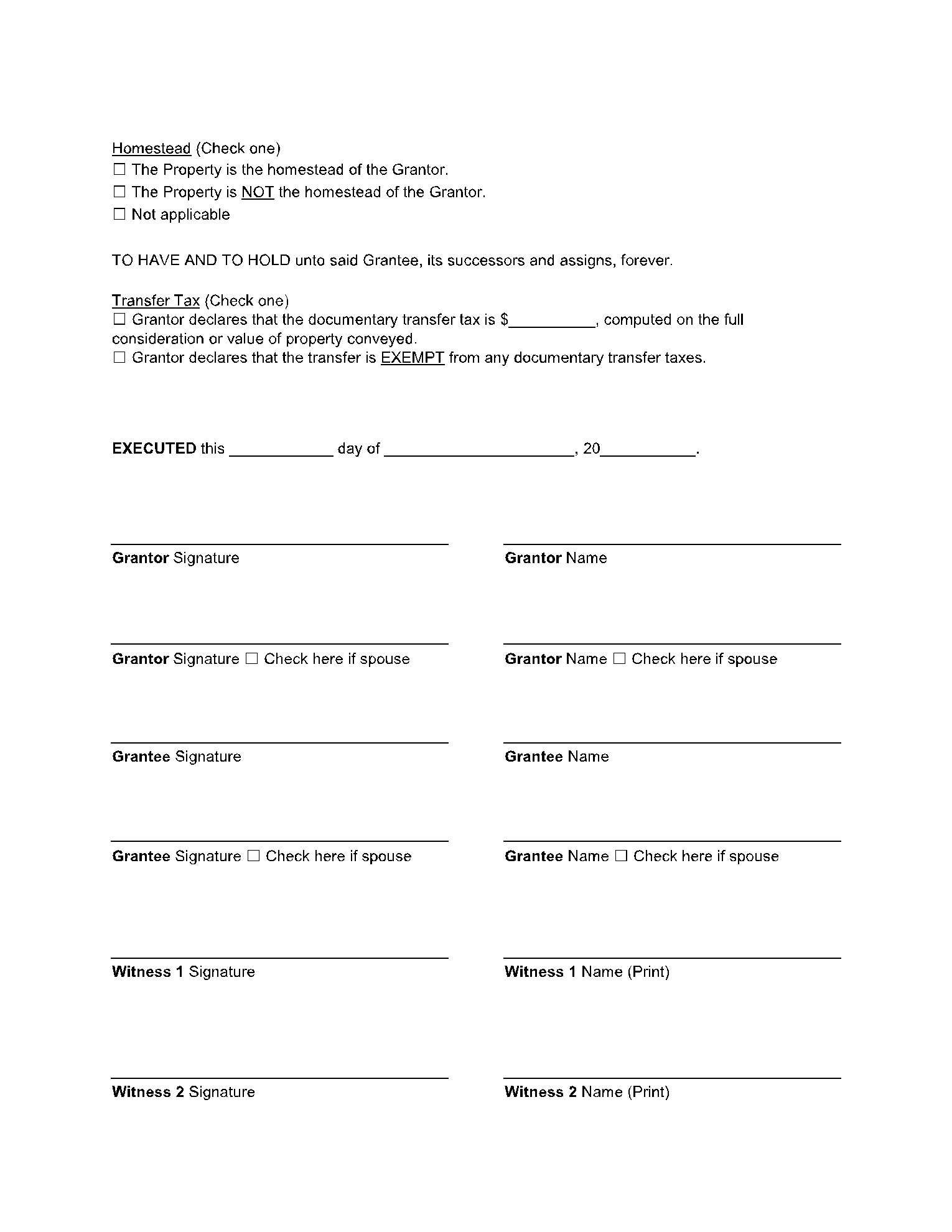

Free Minnesota Quit Claim Deed Form 2021 CocoSign

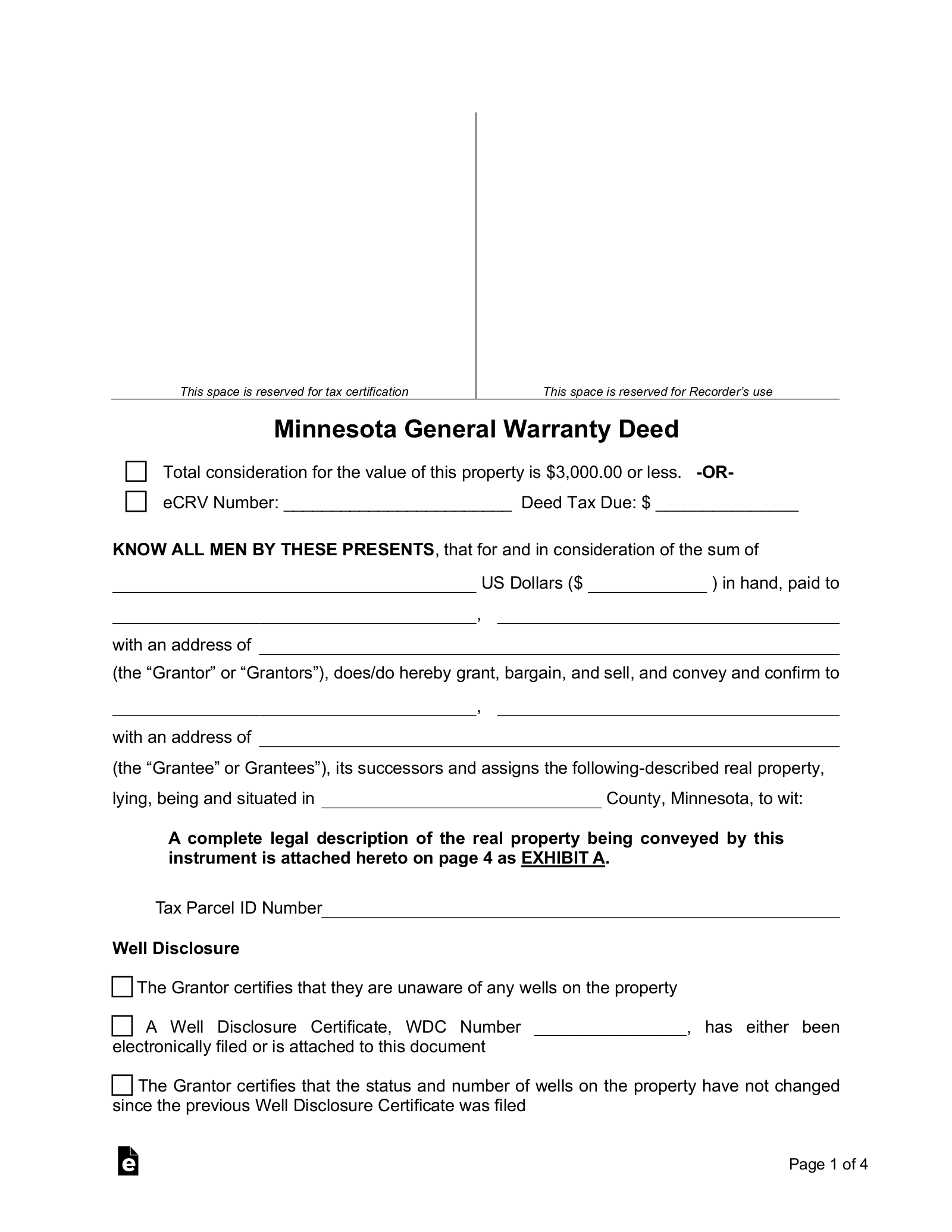

Free Minnesota General Warranty Deed Form PDF Word EForms